Equilibrium prices of the titles: Sharpe and the Securities Valuation Model (CAPM)

DOI:

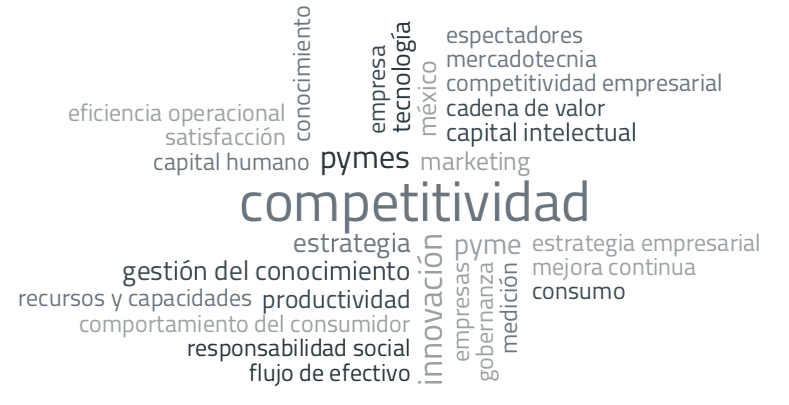

https://doi.org/10.32870/myn.vi49.7705Keywords:

Finance, CAPMAbstract

The Capital Asset Pricing Model (CAPM) is a model used to calculate the profitability that an investor must demand when making an investment in a financial asset, depending on the risk he is assuming.References

BANXICO. (2023). Sistema de Información Económica. Mexico: Banco de México. Link: http://www.inegi.org.mx/sistemas/bie/

Fama, E. & Kenneth R. (2004). The capital asset pricing model: theory and evidence. Journal of Economic Outlook, 18(3), 25-46. DOI: 10.1257/0895330042162430

INEGI. (2023). Banco de Información Económica. Mexico: Instituto Nacional de Geografía y Estadística. Link: http://www.inegi.org.mx/sistemas/bie/

Lintner, J. (1965), Prices of safety, risk and maximum returns of diversification. The Journal of Finance, 20, 587-615. DOI: https://doi.org/10.1111/j.1540-6261.1965.tb02930.x

Mossin, J. (1966). Equilibrium in a capital asset market. Econometrica, 34(4), 768–783. https://doi.org/10.2307/1910098

Perold, A. F. (2004). The Capital Asset Pricing Model. Journal of Economic Perspectives 18(3), 3-24.

Sharpe, W. (1963). A simplified model for portfolio analysis. Management Sciences, 9, 277-293. DOI: https://doi.org/10.1287/mnsc.9.2.277

Treynor, J. L. (1965). How to qualify the management of investment funds. Harvard Business Review, 43(1), 63-75.

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Juan Gaytán Cortés

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.

Mercados y Negocios by Department of Mercadotecnia y Negocios Internacionales. University of Guadalajara is licensed under a License Creative Commons Attribution-NonCommercial 4.0 International.

The author retains the copyright.